AI Robo Trading

The emergence of robo-advisors over a decade ago revolutionized the investment landscape, starting as automated portfolio managers and expanding into comprehensive financial services.

By now, millions of users employ robo-advisors, typically following logical if/then scenarios. For example, if the 50-day crosses the 200-day moving average to the upside and the RSI is below X, go long.

With the advent of artificial intelligence, investors now have a new tool in their arsenal: AI Robo-Trading Bots.

Financial markets are ‘cybernetic systems,’ consisting of hundreds of elements that dynamically impact each other.

Therefore, to achieve a positive win rate, dozens of relevant factors need constant consideration, such as:

- Supply and demand,

- Trading volumes,

- Market sentiment,

- Technical analysis,

- FX rates,

- Inflation and interest rates,

- Company news,

- Exchange opening times, and

- Geopolitical events.

Most of us don’t have the capability, capacity, time, or interest frankly, to consider and synthesize relevant input factors to develop a short- or long-term investment thesis, inclusive of a practical and easy-to-realize trading strategy.

AI Robo Trading Service

Now, what if, you could connect your trading account of choice with a machine-learning enforced and AI-powered Robo trading service (think AITAAS as in ‘AI-Trading As A Service‘)?

This is what we at TradeLand have created: The world’s first AI Robo-Trading Service.

How AI Robo Trading Works

The way it works is simple:

1/ You connect your account via API,

2/ You set up your AI agents,

3/ Your agents start to enter and exit trades.

Our ML-enforced algorithms will identify the best risk/reward ratios automatically, so that you can lean back and just watch the AI do the heavy lifting.

Is It Safe To Use AI Robo Traders?

Your funds always remain in your account, and you never have to trust us with your fund.

The API keys you will set will not allow us to transfer or withdraw any of your assets somewhere else, but rather only enter and exit trades on your behalf.

You can trial our service with our 100% free “Starter Plan”, allowing you to have one running AI agent with a trading pair of your choice, e.g. ETH/USDT. You can have multiple Robo AI Agents with higher tiered plans like the “Pro” or “Institutional Plan”.

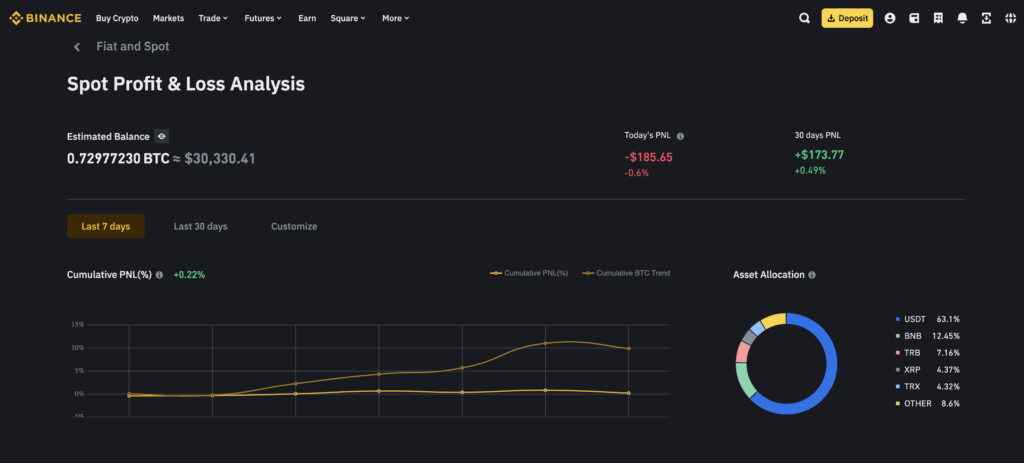

Every transaction your Robo AI Agent entered and exited, is automatically logged by our system, making it easy to track its performance.

AI Trading Performance Dashboard

Besides, as each trade happens in your actual account, you will also be able to see every single one of your trades in your regular exchange account reporting dashboard, e.g. click here

To compete with and beat our AI trading system is not easy, as it i.e.

- analyses hundreds of technical charts of trading pairs every ten seconds 😜,

- reads order books,

- looks at trading volumes,

- reads 100s of indicators,

- looks for abnormalities,

- reads macro-and micro relevant news,

- scans the internet like X.com for actionable events,

It continuously makes ML-enforced price predictions and then fully automatically enters and exit trades without any of your doing.

How To Get Started?

If you are interested in trialing our AI-powered Robo Trading Service, open a (free) account on TradeLand.ai today, connect your account and give it a try!

FAQ

What is a robo trading platform?

A robo trading platform, like TradeLand.ai, is a software system that automates the execution of financial trades on behalf of users.

It utilizes algorithms and predefined criteria to make trading decisions without requiring constant manual input. In our case, we use state-of-the-art artificial intelligence to choose the best time to enter and exit trades.

Is Robo Trading worth it?

Whether robo trading is worth it depends on your individual preferences and goals. It can offer convenience and efficiency, especially for those who prefer a hands-off approach to investing.

However, it’s essential to consider factors like risk tolerance and the level of control you want over your investments.

What is a Robotrader?

A robotrader, or robo-trader, refers to an automated trading system that executes buy or sell orders in financial markets based on predefined criteria. In our case, we offer AI-powered robotraders, operating without constant human intervention, using algorithms to analyze market conditions and make trading decisions.

Which AI Robo trading software is best?

The best AI robo trading software depends on individual preferences, goals, and the specific features you’re looking for. 99% of all options only offer algorithmic or quantitative trading bots, but according to our knowledge, only TradeLand AI so far offers actual AI Robo Trading software.

Is AI Robo trading profitable?

AI Robo trading can be profitable, but success depends on various factors such as market conditions, the chosen strategy, and risk management.

While AI robo-trading systems like TradeLand.ai aim for efficiency and objectivity, it’s crucial to monitor and adjust them based on changing market dynamics for sustained profitability.